Donald Trump’s restrictive customs policy threatens the United States rare economic condition. Experts fear serious stag flation risks.

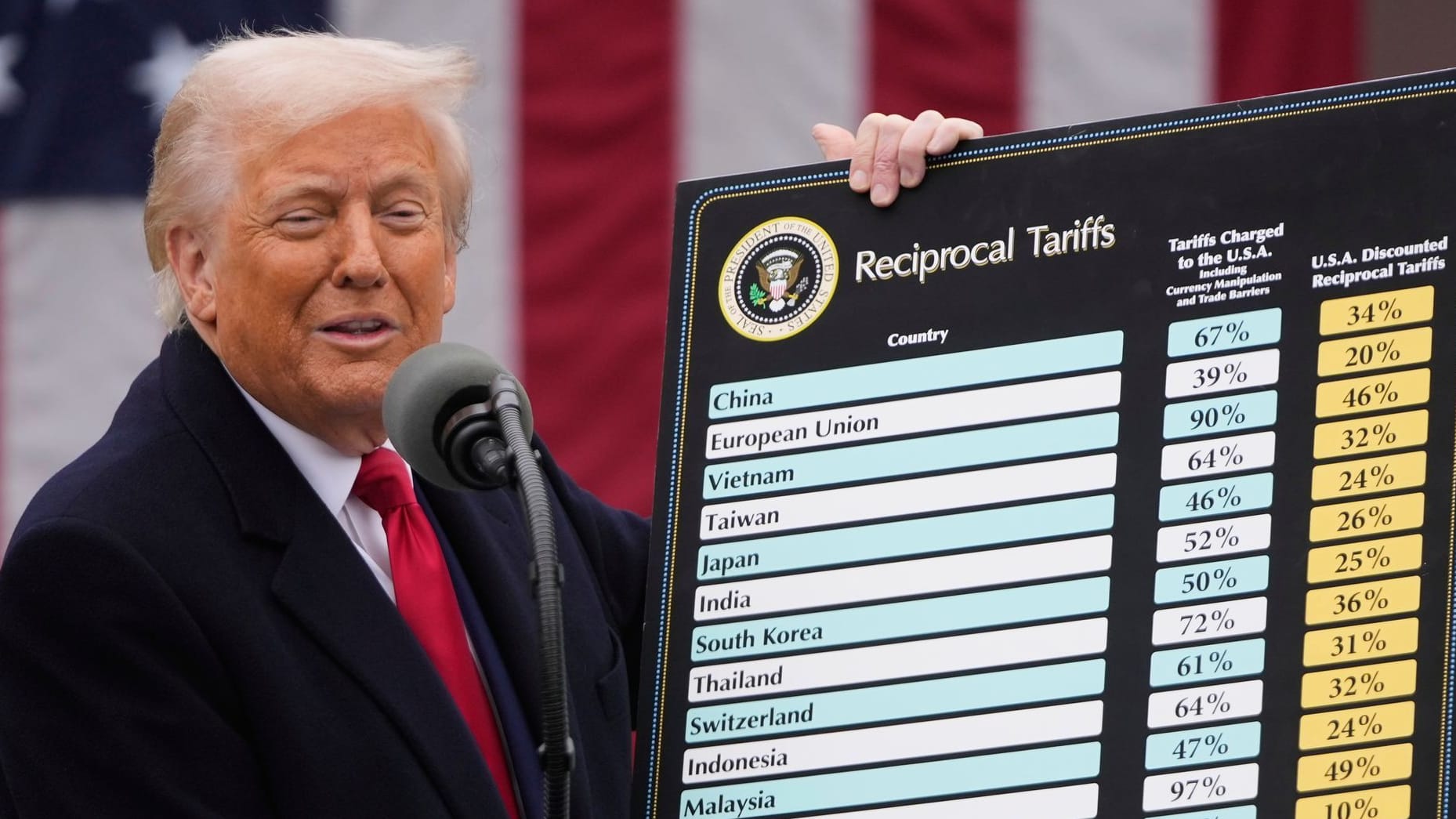

When US President Donald Trump announces the new tariffs against the EU, China and other states, he calls a “day of liberation” in the rose garden of the White House. But the procedure is politically risky – because the consequences for the economy are considerable. Experts warn that the USA is heading for a special economic scenario through Trump’s customs policy.

The US President, who has been in office since January 20, initially covered Mexico, Canada and China with punitive tariffs. In turn, these reacted with trade hurdles for US goods. Trump has now followed further special tariffs against a large number of countries around the world in an all -round.

However, the tariffs are not paid for by individual countries, but by the importers. These usually pass on the additional costs to consumers. Imported goods such as cars or sports shoes will soon become more expensive. Because they are produced in many ways. It should also affect other products.

It is therefore hardly surprising that experts also warn against rising prices as a result of Trump’s customs policy in the United States, especially when the EU and other countries take countermeasures and the customs spiral continues to rotate. “This will not go down in history as a day of liberation, but as a day of stress- especially for American consumers,” says the head of the German Chamber of Commerce and Industry, Volker Treier, in a statement.

The opposition Democrats calculated that Trump’s tariffs would also massively harm US citizens. “The average American family will pay more than $ 5,000 in the year,” said the Democrats faction leader in the Senate, Chuck Schumer, the broadcaster CNN. According to EY-Chef economism Gregory Daco, Trump’s recent customs round could increase the cost of households with low income by $ 1,000-annually.

- Customs announcement: “Trump’s speech is a declaration of war”

The Kiel Institute for the global economy has calculated that the announced tariffs for the US economy should mean a minus of almost 1.7 percent within one year, price increases of more than seven percent and an export minus of almost 20 percent. In US media, worry is currently having concerns about a scenario: a stagflation.

Stagflation is an unusual economic phenomenon. The word “stagflation” is made up of the terms “stagnation” and “inflation”. So a high inflation, which typically goes hand in hand with an economic upswing and falling unemployment, encounter a stagnating economy.

The reason why the phenomena actually does not appear together is the usual interaction between inflation and economic growth: In times of growth, the demand for goods and services increases, which causes companies to expand their production and hire more employees in order to cover the increased demand.

At the same time, many customers are willing to spend more money in the course of an economic upswing. The reason for this is that increased new hires have more people on average over a higher income. Employees also have better chances of enforcing salary increases. This increased willingness to pay in combination with the growing demand for goods makes it easier to enforce price increases. Ultimately, this leads to increasing inflation and a faster loss of value of the money.

It is unusual that the inflation attracts inflation while economic output is stagnating. Such interaction occurs extremely rarely. Stagflation usually arises as a result of offer shocks, protectionist trade strategies or economic policy misconduct.

In the history of the United States, the 1970s are considered a warning example: the Oilförder Cartell Opec had a short of the crude oil production, which drastically killed the oil price. At that time, this oil crisis, poor political decisions and weak growth with high inflation led to significant wealth losses.